State-backed developers are taking over China’s property sector

In this post I look at how China’s property sector has changed to become dominated by state-owned enterprises (SOEs), just as regulators planned for a few years back.

The analysis in this post mainly data-driven looking at sales figures from a selection of 29 (28 for March after Shimao fell) major SOEs and private developers that still report numbers in a reliable manner.

Please note I regard Vanke, Greenland and other developers with significant but not complete state-ownership as SOEs. Some still regard these as private, but I don’t think that is a fair characterisation given that they receive substantial support from local governments that do not accrue to fully private peers. They also receive better financing terms from banks and are viewed more favourably by home buyers.

Beijing always intended for SOEs to take over

At the onset of the reform process now taking place in China’s property sector, the People’s Bank of China sent around a notice to the country’s lenders. The circular described how it wanted banks to prioritise borrowing requests from SOEs and a small number of private developers, with the long-term goal of making the property sector a state-dominated one.

Given that Beijing now has said the purpose of the reform process is to create a “new development model for the real estate sector” that focuses on providing affordable housing for the people – as opposed to making huge profits – it makes sense that SOEs play a larger role. After all, in contrast to their private sector peers, they operate with relatively “soft budget constraints” that allows them to run losses over prolonged periods of time.

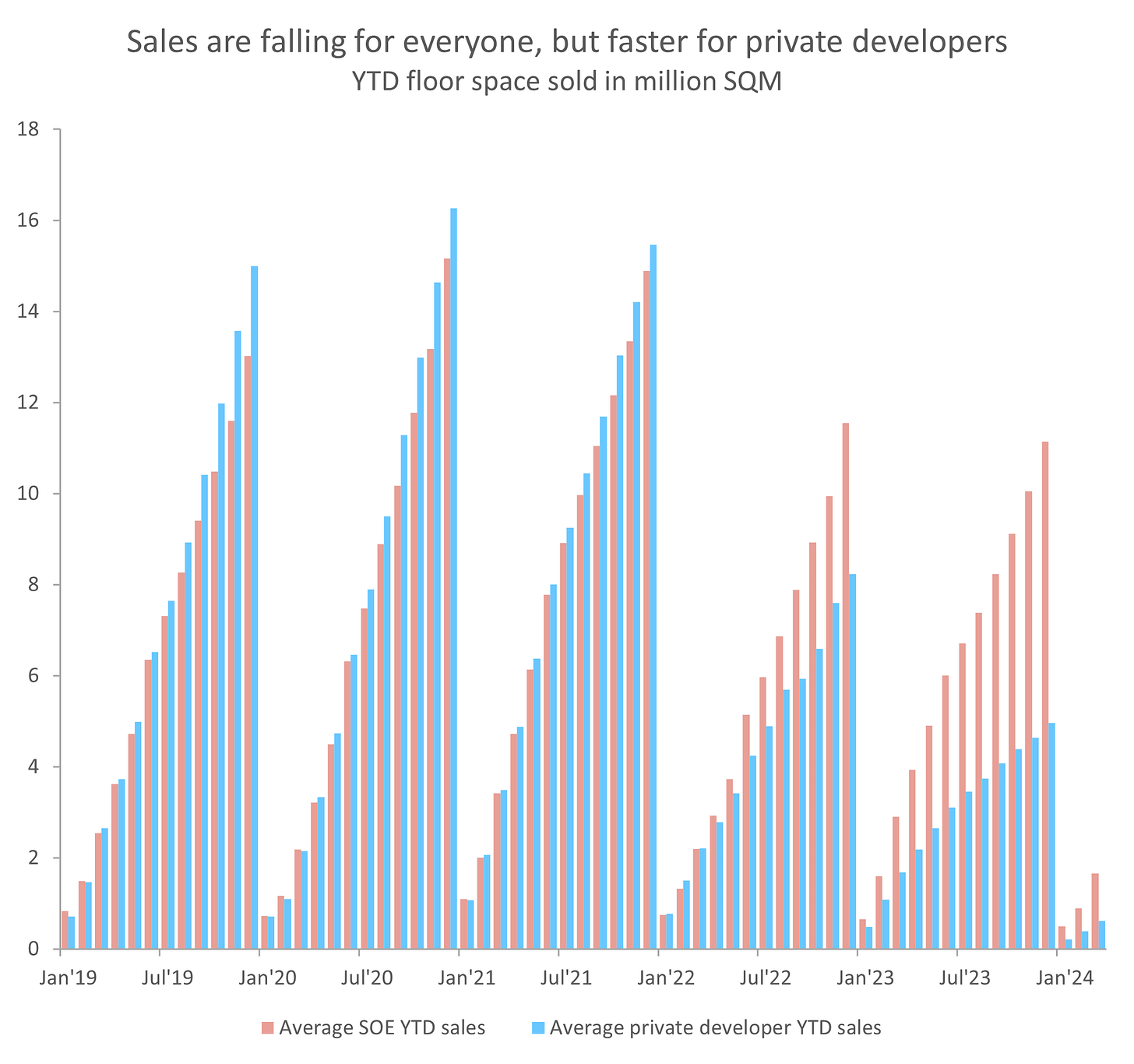

Home buyers shift away from private developers, embracing the safe haven of the state

As the downturn started to take proper hold in 2022, home buyers made a decisive choice by shifting from homes built by private developers to those built by state-backed developers. The key reason was that project delays first started appearing among private developers, with regulators and lenders making it clear they would much prefer to provide financing and other forms of support to SOEs – some of whom also faced difficulties. Speaking to local sources in the financial services industry at the time, they were open about not having much interest in widening their exposure to private developers. Home buyers took note of this trend and adjusted accordingly.

Looking at a smaller group of five SOEs and five private developers who in 2019 controlled about 20% and more than 30% of the market (respectively) in my 29-developer sample, the shift in home buyer preference is even starker. The group of SOEs now control close to 40% of the market, while their private peers have seen their market share shrink to a little more than 7%. Country Garden and Sunac, once two of the country’s largest developers, have turned into medium-sized players with rapidly shrinking market shares.

Note: Central China received a significant investment by an entity linked to Henan Municipal Government in 2022, and should now be regarded as an SOE. The dire state of the Henan property market, combined with a generally struggling local economy, has however meant that the state capital injection has had little effect.

SOE market power gives them pricing power

While private developers are slashing prices to entice buyers (ref. KWG and Logan cutting prices by 40% at their disastrous “Corniche” project in Hong Kong), many SOEs are now raising prices due to some degree of demand stabilisation and growing market power. Importantly, SOEs were also much less aggressive in terms of expansion leading up to the policy-induced downturn in 2021, and are now under less pressure to sell off assets to pay down debt.

This ability to keep prices elevated means that even though everyone except Greentown (more on this below) are seeing drops in sales by volume, some SOEs are seeing some degree of sales improvement in value terms.

China’s new property market king

State-backed Greentown Holdings has emerged as the property downturn’s biggest winner. In March 2019 the Hangzhou headquartered developer was a relatively minor player, recording sales at 4% of Country Garden’s – China’s then largest developer by sales. In March 2024, it sold 74% more properties in volume terms) than Country Garden and has seen its share of sales in my sample group grow from 0.7% to 7.4% during the same period. Only Poly and China State Construction Group now sell more than Greentown, but Greentown is on track to exceed both of them.

While Greentown is also seeing YOY declines in sales by volume, it is in single digits compared to very worrisome double-digit declines for everyone else – including Poly and China State Construction Group. As of March this year, Greentown’s sales are up by 321% in volume terms compared to the same period in 2019. More or less everyone else has seen their sales drop markedly.

This comparatively robust performance is also being recognised in financial markets. While its stock is languishing together with the rest of Hong Kong’s stock market, Greentown bonds mostly trade around 90 cents on the dollar. Although Greentown’s bonds are not immune to extreme market pessimism, and experienced sharp price drops in late 2022 and 2023, they also tend to rebound quite quickly.

More details about Greentown to explain why I regard it as an SOE

Greentown is backed by China Communications Construction Group (CCCG) which holds a 28.4% stake. CCCG is a major SOE and is controlled by The State-Owned Assets Supervision & Administration Commission (SASAC), the government agency that oversees all SOEs. Greentown’s Chairman, Zhang Yadong, previously served as Deputy Mayor of the Dalian Municipal Government – a major port city in northern China. This makes Greentown, without a doubt, an SOE.